Why It’s Time for a Smarter, More Respectful Approach

In Australia’s energy sector, the challenges around debt collection are becoming increasingly complex. With rising living costs and higher energy bills pushing more households into arrears, utility providers are under pressure from both regulators and the public to rethink how they manage collections. Recent fines imposed by energy regulators have highlighted failures in engaging vulnerable customers and maintaining compliance with hardship guidelines — and the message is clear: the old ways of chasing debt no longer work.

Yet, this isn’t just about compliance — it’s about empathy and effectiveness. At DigiU, we believe utilities can recover more, reduce risk, and build lasting customer trust by replacing outdated processes with AI and machine learning-driven strategies. Our omnichannel engagement tools combine data insights and behavioural analytics to deliver personalised, respectful communication — reaching the right customer, at the right time, in the right way.

The Solution

DigiU offers a transformative approach. Leveraging AI and machine learning, we empower utilities to engage proactively with customers through intelligent, respectful, and data-driven omnichannel strategies. By analysing customer behaviour, payment history, and risk profiles, our platform enables personalized outreach that resonates — boosting recovery rates while reducing operational costs.

With real-time insights and predictive analytics, utilities can now shift from reactive collections to proactive engagement. It’s a smarter way to manage debt, improve compliance, and foster better outcomes — for both providers and the communities they serve.

Why Traditional Models Are Failing

Legacy debt collection systems rely on outdated contact strategies—primarily manual calling, static letters, and siloed CRM platforms. These methods are not only inefficient, but they often fail to engage customers at the right time and in the right way.

Enter AI, ML, and Omnichannel Engagement

Modern collections strategies require digital intelligence. With tools like DigiU, utility providers can transform how they engage with customers in debt—prioritising empathy, automation, and efficiency.

Here’s how:

- AI-driven segmentation: Tailor engagement based on customer behaviour, risk profile, and payment history.

- Machine learning for prioritisation: Automate workflows and identify which customers need human intervention versus automated reminders.

- Omnichannel outreach: Seamlessly connect via SMS, email, app notifications, and more—meeting customers where they are.

- Real-time compliance tracking: Ensure all communication is aligned with updated regulations and audit trails are preserved for reporting.

- Smart dashboards: Give internal teams visibility into performance, risk, and ROI.

The Results

Providers using AI-powered collections platforms report:

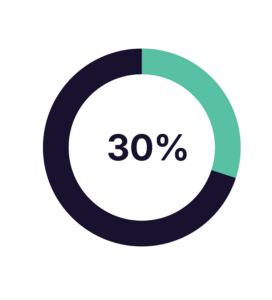

- Up to 30% increase in recovery rate.

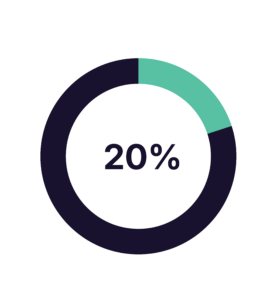

- 20% reduction in bad debt provisions

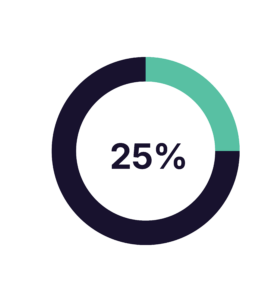

- 25% improvement in customer satisfaction

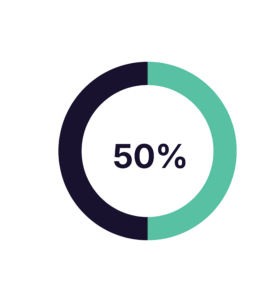

- 50% faster response to regulatory changes

- 15–20% reduction in operational costs

The Future of Collections Is Digital and Respectful

Debt recovery doesn’t need to be adversarial. By modernising the approach with AI, ML, and omnichannel tools, energy companies can reduce their exposure to bad debt, improve customer relationships, and maintain compliance with evolving regulations.

Enhancing Customer Retention through Data and Behavioural Insights

Customer retention is crucial for energy providers to maximise lifetime value, especially during economic uncertainty. Increasing customer retention rates by just 5% can boost profits by 25% to 95%. However, many providers struggle with loyalty, as seen in Q2 2024 when mortgage servicers’ retention rates for refinances dropped to 20%, the second lowest in 17 years. This is due to increased competition, changing economic conditions, and a lack of personalisation.

Key Strategies for Improving Customer Retention

Lenders can improve retention by leveraging data for personalisation, maintaining consistent communication, offering loyalty rewards, and utilising retention triggers.

- Leverage data for personalisation: Use customer data to offer tailored products and refinancing options based on financial behaviours. Using credit attributes, trended data, and alternative credit data can help provide deeper insights into your customers.

- Maintain consistent communication: Keep customers informed with regular updates about interest rate changes or new loan products. Use a variety of communication channels, including email and in-app messaging, to ensure customers are kept in the loop.

- Offer loyalty rewards: Develop programs that reward repeat business and referrals. Offer special rates or discounts for returning customers or for those who refer friends and family to your services.

- Utilise retention triggers: Identify key events for engagement with automated retention triggers. For example, a borrower who has a mortgage with a fixed rate may be less likely to consider refinancing unless prompted.

Data-Driven Strategies for Customer Engagement

Data-driven marketing leverages real-time insights, behavioural patterns, and predictive analytics to craft tailored experiences that address customer needs and preferences. By integrating advanced data analytics into customer engagement initiatives, businesses can identify trends, anticipate challenges, and uncover opportunities for growth.

Key Benefits of Data-Driven Marketing

- Improved Personalisation: Craft messages and offers that truly resonate with individual customers, boosting satisfaction and loyalty.

- Enhanced Customer Journey Mapping: Gain a comprehensive understanding of the customer journey to optimise every touchpoint.

- Increased ROI Through Targeted Campaigns: Maximize the effectiveness of marketing spend by focusing on high-impact strategies.

- Real-Time Adaptability: Stay ahead of competitors by leveraging real-time data insights to adjust strategies on the fly.

Transforming Collections with AI and Machine Learning: DigiU’s Approach

In today’s dynamic business environment, understanding and managing customer behaviour is crucial for effective collections and customer retention. DigiU, a leader in AI and machine learning solutions, is at the forefront of this transformation, leveraging advanced technologies to create personalized, respectful, and efficient collection processes.

Understanding Customer Behaviour with Data and Analytics

DigiU’s approach to collections is built on a foundation of data-driven insights. By analysing customer behaviour, payment history, and risk profiles, DigiU can tailor its engagement strategies to meet the unique needs of each customer. This personalised approach not only improves collection outcomes but also enhances customer satisfaction and loyalty.

Key Strategies for Effective Collections

- AI-Driven Segmentation: DigiU uses AI to segment customers based on their behaviour, risk profile, and payment history. This allows for targeted engagement strategies that resonate with individual customers, increasing the likelihood of successful collections.

- Predictive Analytics: By leveraging predictive analytics, DigiU can anticipate customer needs and potential issues before they arise. This proactive approach enables timely interventions and personalized solutions, reducing the risk of delinquency.

- Omnichannel Engagement: DigiU employs omnichannel communication strategies to reach customers through their preferred channels, whether it’s SMS, email, or app notifications. This ensures that customers receive timely and relevant information, enhancing their overall experience.

- Real-Time Compliance Tracking: DigiU ensures that all communication and collection activities comply with regulatory requirements. This not only protects the company from legal issues but also builds trust with customers by demonstrating a commitment to ethical practices.

Enhancing Customer Retention and Satisfaction

DigiU’s focus on customer-centric solutions extends beyond collections to include strategies aimed at improving customer retention and satisfaction. By understanding customer behaviour and preferences, DigiU can offer personalized experiences that foster long-term loyalty.

Strategies for Customer Retention

- Personalised Customer Journeys: DigiU uses customer data to map out personalised journeys, identifying key touchpoints and opportunities for engagement. This tailored approach ensures that customers feel valued and understood.

- Automated and Consistent Communication: By automating marketing and communication tasks, DigiU ensures that customers receive consistent and timely updates. This consistent engagement keeps the brand top-of-mind and maintains a positive relationship with customers.

- Continuous Innovation: DigiU is committed to continuous innovation, regularly updating its products and services to meet evolving customer needs. This forward-thinking approach ensures that DigiU remains competitive and continues to deliver value to its customers.

Conclusion

DigiU’s approach to collections and customer retention is rooted in advanced AI and machine learning technologies. By understanding and anticipating customer behaviour, DigiU can create personalized, respectful, and effective collection strategies. This not only improves collection outcomes but also enhances customer satisfaction and loyalty, positioning DigiU as a leader in the digital transformation of the utility sector.

For more information on DigiU’s innovative solutions and how they can benefit your business, visit www.digiu.com.au